iowa income tax withholding calculator

Enter your gross income. The incomes of both spouses must be combined to determine if you meet this exemption from tax.

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

. Income tax calculator California Find out how much your salary is after tax. The Iowa salary paycheck calculator will calculate the amount of Iowa state income taxes that are withheld from each paycheck. Social Security - 3410.

Where do you work. Where do you work. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a.

Enter your gross income. Details on how to only prepare and print a Iowa 2021 Tax Return. Below are forms for prior Tax Years starting with 2020.

Iowa residents are subject to personal income tax. Your latest submitted W-4 Form for the given job is also helpful so you can compare your new. Previously the tax rate.

These back taxes forms can not longer be e-Filed. SDI State Disability Insurance - 660. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

Income included to determine exemption. Federal Income Tax - 5088. Social Security - 3410.

You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state. All you need is the Form 1040 of your 2020 Tax Return or your 2021 or 2022 Tax Return income estimates. Use our Withholding Calculator to review your W-4.

Federal Income Tax - 5088. Fields notated with are required. State Income Tax - 2115.

Illinois maximum marginal income tax rate is the 1st highest in the United States ranking directly below Illinois. The Illinois income tax was lowered from 5 to 375 in 2015. Total tax - 9295.

Net pay 45705. The following items must be included when determining if you are eligible for the 9000 exemption or the 13500 exemption 24000 or 32000 if 65 or older on 123121. Iowa Income Tax Forms.

Medicare - 798. There are nine different income tax brackets in the Iowa tax system. Income tax calculator Texas Find out how much your salary is after tax.

If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. Iowa State Income Tax Forms for Tax Year 2021 Jan. A deduction is a specific amount.

This tool factors in the when you adjust a W-4 during the year and the tax withholding results will be based on the remaining time until December 31. Medicare - 798.

Calculating Withholding Allowances Contractor Licensing Blog

Tax Withholding For Pensions And Social Security Sensible Money

Chapter 6 Accounting For Income Tax Overview Accounting

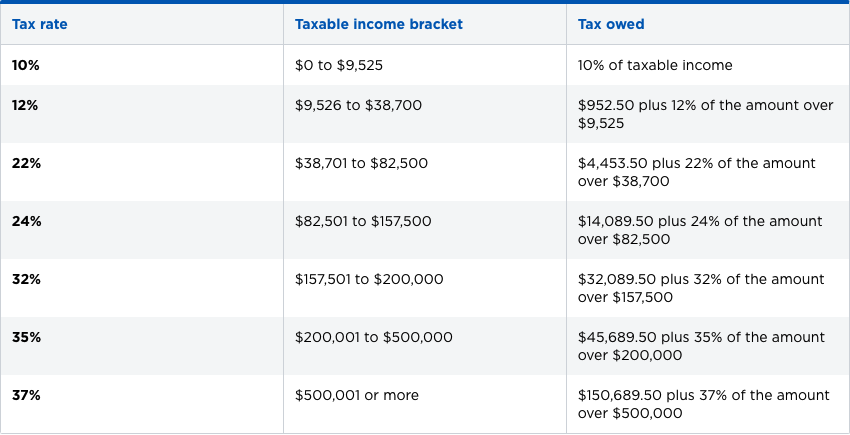

Federal Income Tax Brackets Brilliant Tax

Massachusetts Income Tax Rate And Brackets 2019

Income Tax Calculator 2020 2021 Estimate Return Refund